Income statements are the central hub of small businesses’ financial statements. An income statement shows a company’s revenue, total operating expenses, and net income. They are important in part because they supply the latest info and one for a prior period, so comparisons are easier.

An income statement is an important cog in the small business financials wheel. Asking what is a cash flow statement? These have a more narrow focus. An income statement is different from other reports.

Asking what is a profit and loss statement or what is a balance sheet? The first corrals expenses, costs and revenue for a period. A balance sheet is another one of the group of statements SMBs need.

What is Meant by an Income Statement?

An income statement works with other financial statements. Like a cash flow statement and a statement of retained earnings, plus a balance sheet. This financial statement covers assets, liabilities, and shareholder equity.

What is the Main Purpose of an Income Statement?

This kind of financial report covers core business activities.

Read More: what is a cash flow statement

Why Income Statements are so Important for Small Businesses

Income statements matter to small business success. Here are 5 reasons why.

They Highlight Trends

They establish a company’s financial performance. For example, they can show you if you’re missing the sales revenue on a specific reporting period. And they are a good indicator of a company’s financial health.

They Classify Revenues and Expenses

Business owners can get an idea of how departments are working. Both expenses and revenues get listed. It is another way for investors to gauge a company’s fiscal health too.

They Help With Tax Compliance

Company management teams need to think about income tax. An accurate income statement helps stay in line with tax regulations. These are necessary for income taxes.

They Indicate Profitability

These statements provide a good picture of a company’s profitability. Take expenses and subtract revenues to get net profit for a reporting period.

The Help With Financing

Potential lenders look at business activities like balance sheets and income statements.

Main Components of an Income Statement

An income statement has different parts. Three big ones and some others listed below.

Remember the income tax expense appears on the next to last line of these statements.

1. Revenue

The top line item on an income statement. A good indicator of a small business’s financial health. The amount of net income or total revenue a business makes.

2. Net Income

Also known as net profits. An income statement template will usually have this last. The best snapshot of a business’s financial standing.

3. Expenses

Covers all the items and expenses incurred to generate revenue over a reporting period. Expenses can be broken down into two subcategories. Both of these are important to calculate net income.

4. Cost of Goods Sold

Also called direct costs, it is directly involved in the cost of the services or products sold. These are broken down in an income statement into overhead, labor, and material costs. A service company won’t have materials for this calculation.

5. Operating Expenses

Every expense related to operations. Rents, utilities, salaries. Administrative expenses are added in.

6. Non-Operating Expenses

These expenses are costs not related to day-to-day operations. These appear at the bottom of an income statement. Indirect costs like income statements are included.

7. Gross Profit

Calculated by subtracting the cost of goods sold from the revenue. Important for any particular period.

8. Net Income Before Taxes

Pre-tax income needs to be included. The income after taxes gets added on too. Gain and losses figure into finalizing a company’s income.

Read More: what is a profit and loss statement

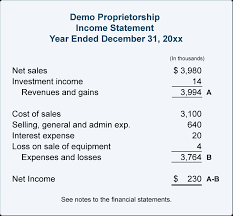

Income Statement Example

Income statements are essential to financial accounting. They need to include items like gross profit and operating income to provide a clear picture.

This type of earnings statement arrives at net income in one step. Multi-step income statements separate operating revenue and expenses from non-operating revenues and expenses.

How to Create an Income Statement

Getting an income statement definition right is one thing. But to calculate the income you need to put one together.

- Select A Reporting Period – Before you dig deep into items like gross profit, pick a time frame. Monthly for small businesses works. You’ll get a good idea of profit or loss trends.

- Get A Trial Balance Report – This is the beginning of these important financial statements. Cloud-based software helps.

- Calc Revenues – Any company selling goods and services needs to know how much. Net sales matter to cash flow numbers.

- Costs of Goods Sold – Add overhead costs, labor and materials. The total cost of office staff, even office supplies.

- Gross Margin – Subtract the costs of goods sold from revenue.

- Add Operating Expenses – Get these from the trial balance report.

- Calc Income – Arrive at the pre-tax income.

- Add Taxes – Calculate the income tax.

- Arrive at Net Income – Subtract income tax from pre incomes tax figures.

Read More: what is a balance sheet

Analyzing an Income Statement

Got an income statement completed? Here are a few tips on analyzing one.

Look At The Income Sources

Look over items like operating income. Here are a few formulas. Recheck all these sources. Like interest income, this is revenue earned by lending out money.

Double Check The Math

Mistakes happen. But an error on a multi-step income statement can change the results, go through addition and subtraction. You’ll get a good idea of how things like interest expenses fit in.

Go Over The Expenses

Do items like the advertising expenses make sense? Do the employee wages fit into the total expenses properly? Check and analyze to see where future expenses can be tweaked.

Look At The Big Picture

Now, look at the numbers for any significant changes. Pay attention to the cash flows arising from associated operating activities. Like costs incurred from management and marketing.

Don’t ignore any trends arising from non-core business activities. Like relocating, paying down a loan, and travel expenses to name a few. Watch for any non-operating expense that sticks out.

Compare YoY Statistics

The weighted average shares outstanding is the number that fluctuates. This will show trends in buybacks etc. Comparing other items like the cost of sales gives you a snapshot of the direct materials used.

Are the fixed assets costing more? Look at things like computer equipment.

Image: Depositphotos